New premium trading journals for forex, crypto, stocks & shares, spread betting and lots. Buy Premium Journals - Di. 🐙Deposit $100 and get 4 FREE stocks valued up to $1600: favorite book to learn about options: Follow me. For over eight years, TJS has been a main supplier of Excel-based spreadsheets for merchants, and a small enterprise devoted to offering one of the best in Tracking & Analysis instruments. Greg Thurman, creator of the TJS, devotes his days to sustaining, progressing and supporting the Trading Journal Spreadsheet for its hundreds of customers. This trading journal excel guide, has a spreadsheet download. It is the core of any trader’s toolbox. It helps identify your trading weaknesses, strengths, and areas of improvement. Don't let the word 'journal' confuse you into thinking its a place where you write a few lines about a few trades and you're done!

Read New Posts Explaining Forex Position Trading Log, Trading Journal – My Excel Spreadsheet Trading Journal (+ Free Trading Journal Spreadsheet!).

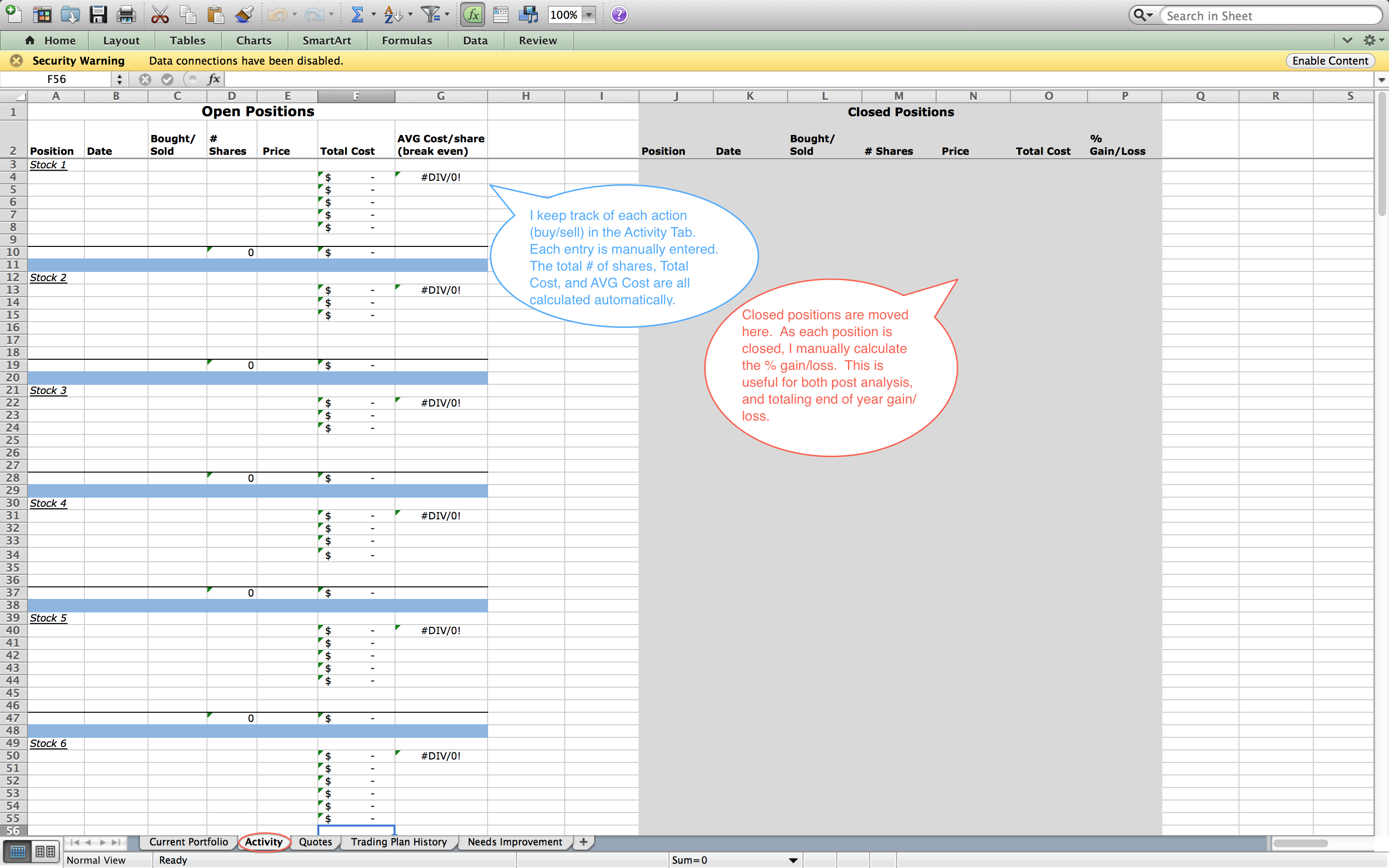

In this video – ‘How I Use My Excel Spreadsheet Trading Journal’ I briefly talk about the different options available when it comes to choosing what to actually create your trading journal in – mainly Microsoft Excel or Evernote. I then move on to what information you should record in your journal spreadsheet.

Learn what information should be recorded in a trading journal + get a free copy of my trading journal. This can be used as a Forex trading journal.

In this video – ‘How I Use My Excel Spreadsheet Trading Journal’ I briefly talk about the different options available when it comes to choosing what to actually create your trading journal in – mainly Microsoft Excel or Evernote.

I then move on to what information you should record in your journal spreadsheet. I show you my personal trading journal spreadsheet and explain the reasons why I record what I record.

Lastly, I explain how you can get a copy of my Excel Spreadsheet trading journal if you want one.

To download the spreadsheet go to: https://www.disciplinedtrader.co.uk and sign up to the Academy. You can then go to the Trading Journal section and download the spreadsheet for free.

My Previous Video – https://youtu.be/–V9bEEO4Dw

Trading Journal Spreadsheet Torrent

Subscribe to the YouTube Channel for more videos: https://www.youtube.com/c/DisciplinedTraderUK

Check out the Disciplined Trader blog: http://www.disciplinedtrader.co.uk

Follow me on Twitter: https://twitter.com/disciplinedtrad

Follow me on Instagram: https://www.instagram.com/disciplined_trader/

Follow me on Facebook: https://www.facebook.com/disciplinedtrader/

Forex Position Trading Log, Trading Journal – My Excel Spreadsheet Trading Journal (+ Free Trading Journal Spreadsheet!).

Recognizing Short Positions.

When creating a brief position, one need to recognize that the trader has a finite capacity to gain a profit and unlimited capacity for losses. That is because the capacity for a profit is restricted to the stock’s distance to absolutely no. Nonetheless, a stock can possibly rise for years, making a series of higher highs. Among one of the most unsafe elements of being short is the capacity for a short-squeeze.

A short-squeeze is when a greatly shorted stock unexpectedly starts to increase in price as investors that are short begin to cover the stock. One well-known short-squeeze took place in October 2008 when the shares of Volkswagen rose higher as short-sellers rushed to cover their shares. Throughout the short-squeeze, the stock increased from roughly EUR200 to EUR1000 in a little over a month.

Trading Journal Spreadsheet Review

What is a Short-Position.

A brief, or a brief position, is developed when a trader sells a safety first with the purpose of redeeming it or covering it later on at a lower price. An investor might determine to short a safety when she believes that the price of that security is most likely to decrease in the future. There are 2 kinds of short positions: nude and covered. A nude short is when a trader sells a safety without having belongings of it. Nonetheless, that technique is unlawful in the UNITED STATE for equities. A covered short is when a trader obtains the shares from a stock car loan department; in return, the trader pays a borrow-rate during the time the short position remains in location.

In the futures or forex markets, short positions can be developed at any time.

Recognizing Short Positions.

When creating a brief position, one need to recognize that the trader has a finite capacity to gain a profit and unlimited capacity for losses. That is because the capacity for a profit is restricted to the stock’s distance to absolutely no. Nonetheless, a stock can possibly rise for years, making a series of higher highs. Among one of the most unsafe elements of being short is the capacity for a short-squeeze.

Trading Journal Spreadsheet Free

A short-squeeze is when a greatly shorted stock unexpectedly starts to increase in price as investors that are short begin to cover the stock. One well-known short-squeeze took place in October 2008 when the shares of Volkswagen rose higher as short-sellers rushed to cover their shares. Throughout the short-squeeze, the stock increased from roughly EUR200 to EUR1000 in a little over a month.

- A brief position describes a trading method in which a capitalist sells a safety with strategies to buy it later on.

- Shorting is an approach used when a capitalist anticipates the price of a safety will fall in the short term.

- In common technique, short sellers borrow shares of stock from a financial investment bank or various other financial institution, paying a charge to borrow the shares while the short position remains in location.

Read New Posts Explaining Forex Position Trading Log and Financial market information, evaluation, trading signals and Forex financial expert reviews.

Risk Warning:

“TradingForexGuide.com” TFG will not be held responsible for any kind of loss or damages arising from reliance on the details had within this internet site including market information, evaluation, trading signals and Forex broker reviews. The data had in this internet site is not necessarily real-time neither exact, and evaluations are the opinions of the author and do not represent the suggestions of “TradingForexGuide.com” TFG or its employees. Money trading on margin involves high danger, and is not ideal for all financiers. As a leveraged product losses are able to exceed initial deposits and resources is at danger. Prior to choosing to trade Forex or any other monetary tool you must carefully consider your investment purposes, level of experience, and danger cravings. We work hard to supply you important details regarding every one of the brokers that we assess. In order to offer you with this totally free service we receive advertising costs from brokers, including a few of those provided within our positions and on this page. While we do our utmost to make sure that all our data is up-to-date, we motivate you to confirm our details with the broker straight.